FFECT OF DEBT FINANCING ON BUSINESS PERFORMANCE: A COMPARATIVE STUDY BETWEEN I&M BANK AND BANK OF KIGALI, RWANDA

Abstract

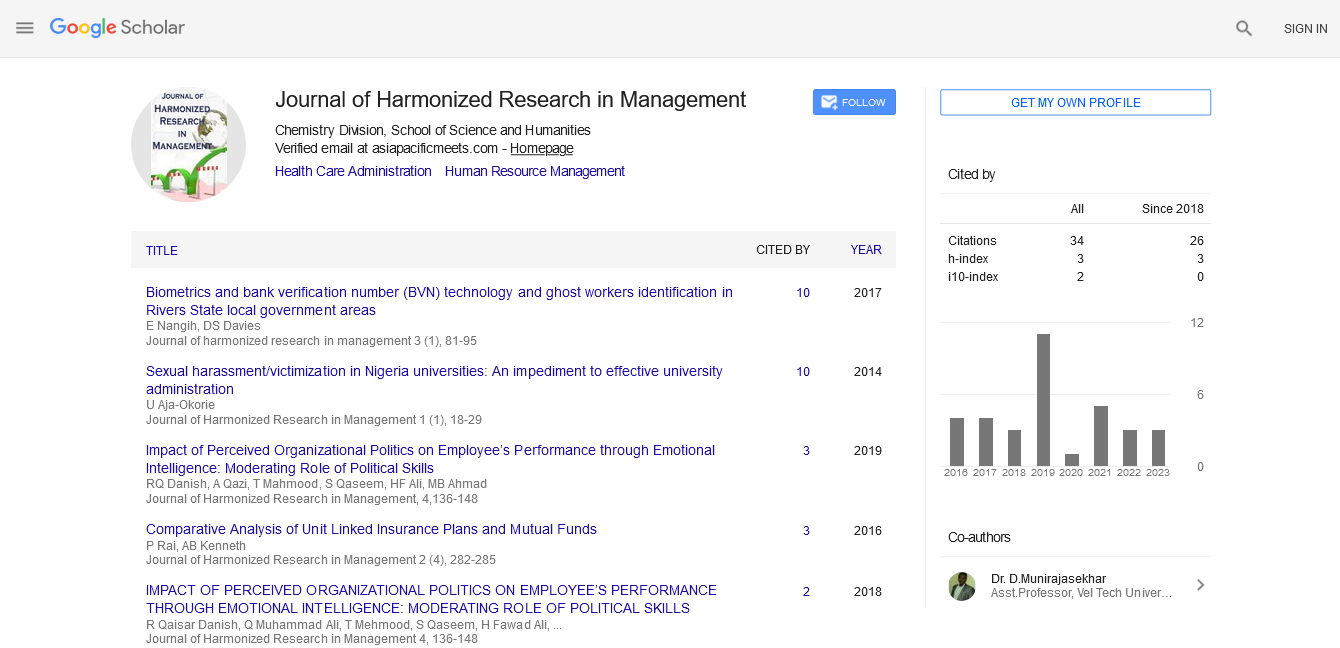

Author(s): Journal of Harmonized Research in Management

The effect of debt financing on firm performance is of considerable importance to all bank business. The study is focussed on establishing the effect of debt financing on firm performance, a compara tive study between I&M Bank and Bank of Kigali within a period of six years from 2010. The study was descriptive and correlative in nature. The study found a strong positive relationship between debt level and profitability for both I&M bank and Bank of Kigali. This tends to be less expensive and increasing it with a relatively low interest rate which leads to the increase in profit levels and hence performance. The sustainability indicators shows that, Bank of Kigali was very stable in internal financial health with average SGR of 21% and IGR of 1.7% than its competitor I&M Bank with average SGR of 10% and IGR of 0.6%. However, the debt levels are not influenced by the variation on both SGR and IGR. The study concludes that Bank of Kigali was the best financial performer than its competitor I&M Bank. These were shown by the fact that during the period of last six years, the average ROE is 21% for BK against 26% for I&M Bank , average ROA is 4% for BK against 3% for I&M Bank, average LA is 51% for BK against 47% for I&M Bank, average LD is 74% for BK against 60% for I&M Bank, average SGR is 21% for BK against 10% for I&M Bank and finally average IGR is 3% for BK against 2% for I&M Bank

Google Scholar citation report

Citations : 92

Journal of Harmonized Research in Management received 92 citations as per google scholar report