INVESTIGATING COMPLEX FINANCIAL CRIME ? A CASE STUDY INSPIRED BY THE POLLY PECK PLC FRAUD

Abstract

Author(s): Paul Eisenberg

The purpose of this article is to illustrate a financialfraud investigation by the way of a case study inspired by the famous Polly Peck PLC fraud case. After exploring the features of an investigat ion plan, false accounting and theft charges are explained and exemplified. Various techniques of tracing the crime proceeds are analysed, as well as investigative models and methods to provide evidence. Methodologically, economic fraud investigations are discussed through an in-depth literature review. The investigative models applied are characterised by Data Mining techniques (Decision Trees, Neural Networks and Benford’s law) as well as the Net Worth Method, the Bank Deposit Method, the Specific Item Method and Digital Link Analysis. The case study shows that Benford’s law and Neural Networks, together with the Specific Item Method can render results admissible in criminal court in cumbersome financial fraud cases involving several jurisdictions and complex banking arrangements.

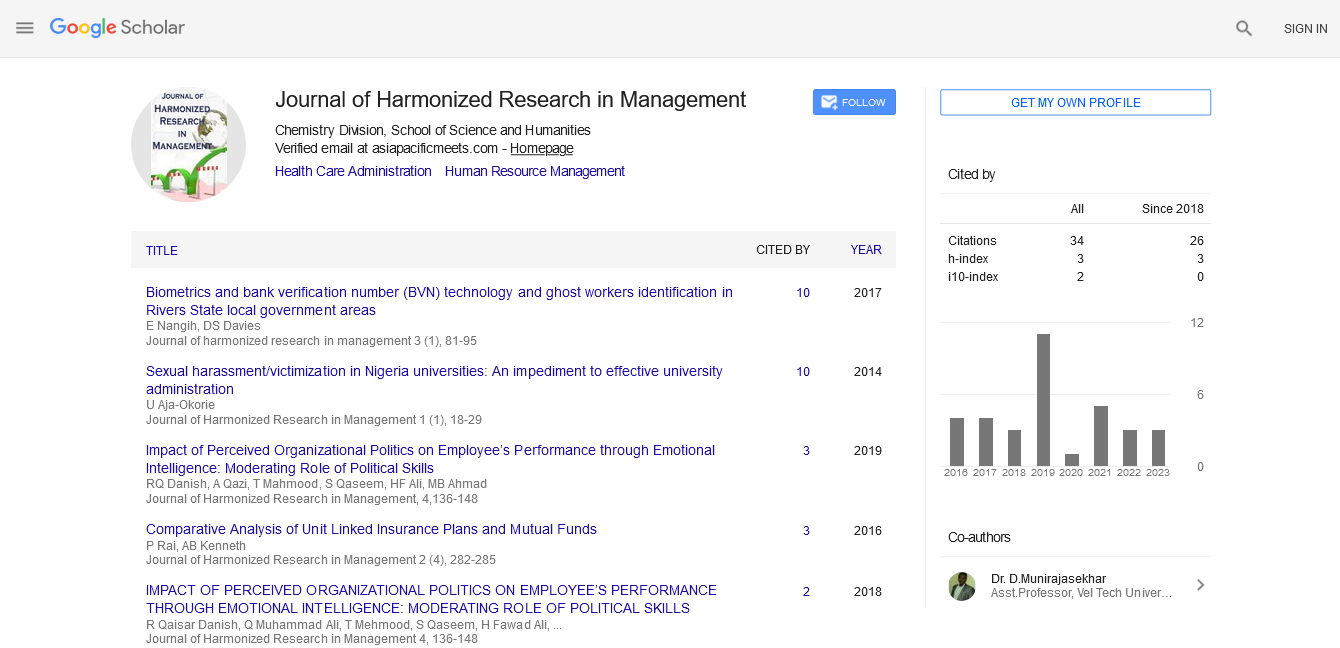

Google Scholar citation report

Citations : 92

Journal of Harmonized Research in Management received 92 citations as per google scholar report