IS BOARD SIZE AND FINANCIAL LEVERAGE DETERMINANTS OF EARNINGS MANAGEMENT?

Abstract

Author(s): Benjamin Agyeman, Quarshie Dorcas, James Bonn

This study looks at the factors that influence earnings management practices of financial institutions listed on the Ghana Stock Exchange from the period 2010-2018. The study adopted quantitative de sign, as data on Total Accrual, firm size, firm age, leverage, auditor size, and firm age were sourced from published annual report of nine (9) financial institutions listed on Ghana Stock Exchange from 2008 – 2018. Results from the regression model under a 5% significance level reveal that Board size and financial leverage are the factors influencing earnings management practice amongst listed financial institutions. Results from the correlation model also document a negative correlation between Auditor side, Financial Leverage and Earnings management while Board size, Firm size, and Firm age reveal a positive correlation with earnings management. The study therefore recommends that, the regulatory bodies of financial institutions ensure that listed firms are once in a while audited by the big four (4) audit firms. An independent committee should be set to performance an oversight responsibility for the board of directors.

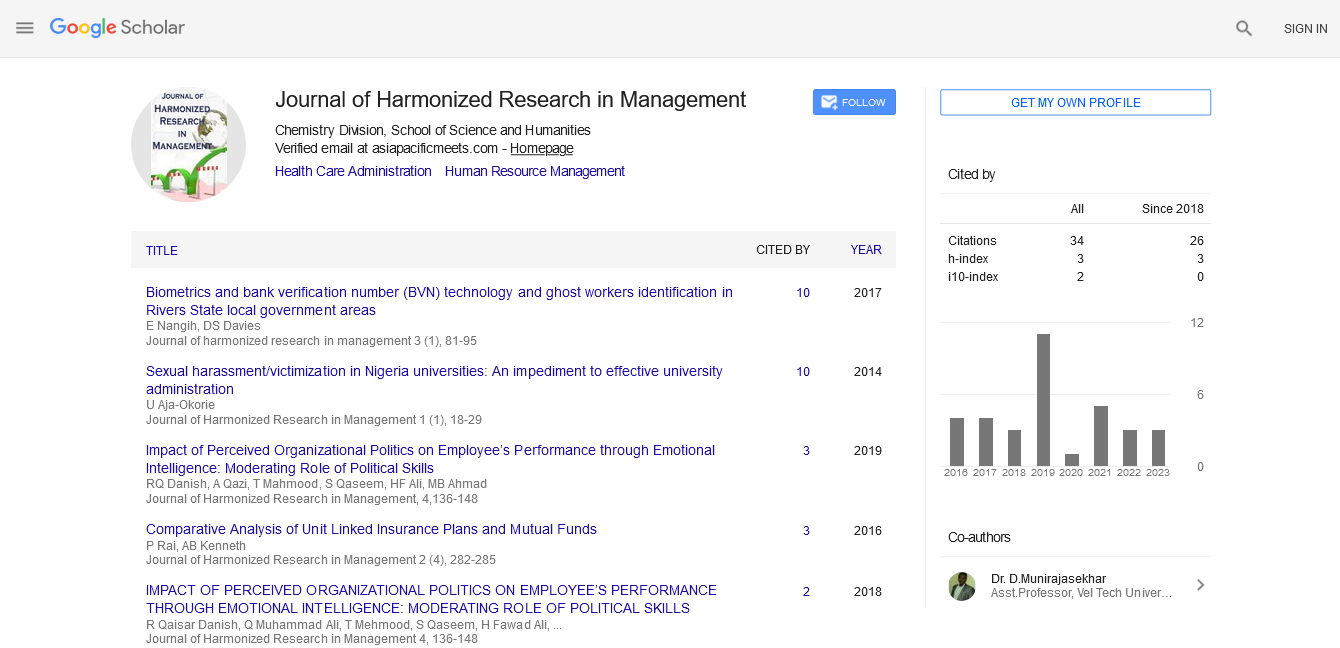

Google Scholar citation report

Citations : 92

Journal of Harmonized Research in Management received 92 citations as per google scholar report