STOCK PRICE PREDICTION USING NEURAL NETWORK

Abstract

Author(s): Nisha Yadav, Shikha Yadav, Preeti Dhanda

In recent years researchers have developed a lot of concern in stock market prediction because of its dynamic & unpredictable temperament. Predicting anything is very tough especially if the relationship between the inputs and outputs are non-linear in nature and stock price prediction is one of such item. Predicting stock data with customary time series analysis has proven to be intricate. An artificial neural network may be more pertinent for the task .Primarily because no postulation about a suitable mathematical model has to be made prior to forecasting. Furthermore, a neural network has the knack to extract useful information from hefty sets of data, which frequently is required for a satisfying description of a financial time series. There have been vast studies using artificial neural networks (ANNs) in the stock market prediction. A large number of triumphant applications have shown that ANN can be a very handy tool for time-series modeling and forecasting. Much research on the applications of NNs for solving industry problems has established their advantages over statistical and other methods that do not embrace AI, although there is no optimal methodology for a certain problem. In order to recognize the main benefits and limitations of previous methods in NN applications and to find associations between methodology and problem domains, data models, and outcome obtained, a proportional analysis of selected applications is conducted. It can be concluded from inspection that NNs are most implemented in forecasting stock prices, takings, and stock modeling.

betsat bettilt vegabet betkanyon matbet celtabet hilbet melbet kingbetting wipbet pusulabet superbahis lidyabet holiganbet 1xbet asyabahis jetbahis betdoksan betetebet betgram

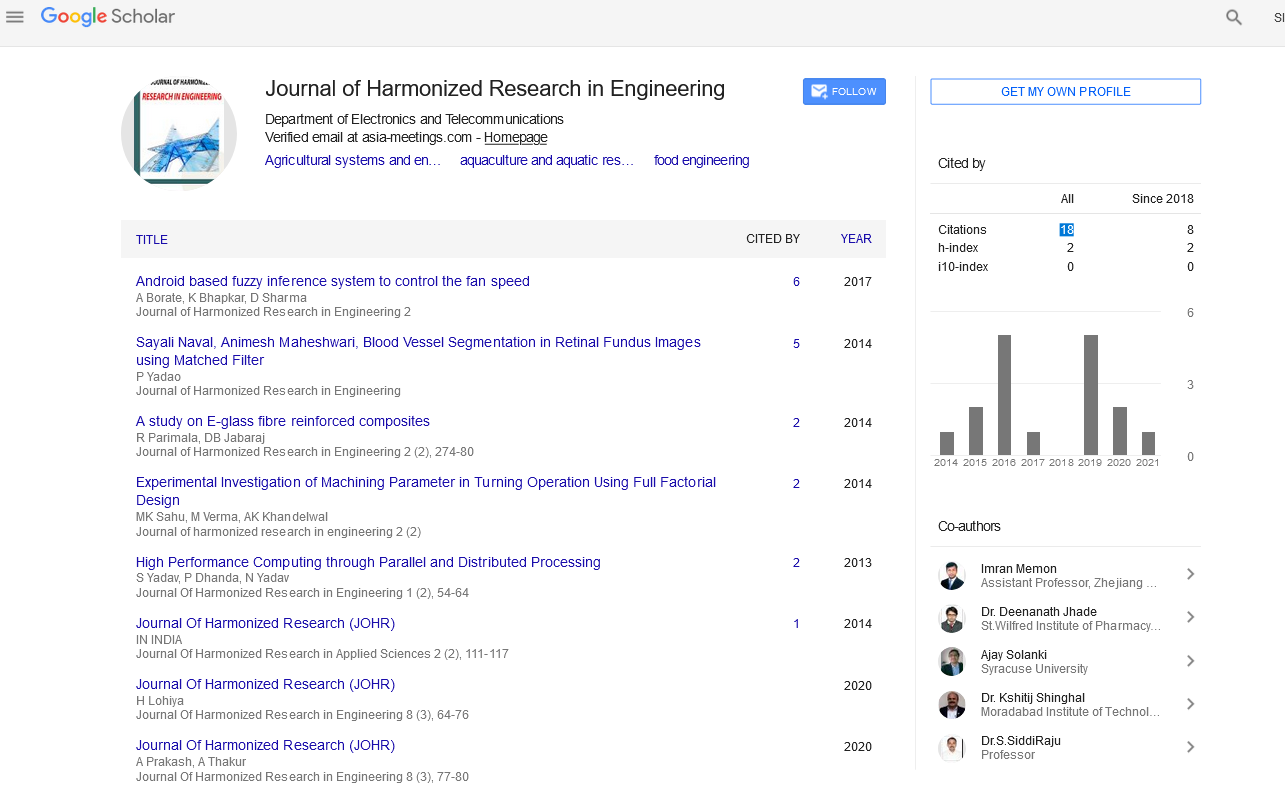

Google Scholar citation report

Citations : 43

Journal of Harmonized Research in Engineering received 43 citations as per google scholar report